Click on any of the topics below to expand and start learning

What is the Stochastic RSI?

A derivative of the Relative Strength Index. It consists of two lines, K (usually blue) and D (usually red).

When blue line crosses over red line it is considered as a bullish crossover

When red line crosses over blue line it is considered as a bearish crossover

What is the Volume Weighted Average Price (VWAP)?

VWAP is similar to a moving average, but the difference between the both is that it incorporates not only price but also volume. Where the VWAP is, there is a lot of volume transacted in that area. When price is below VWAP then it is considered as below value price but when it is above VWAP then it is considered as above value.

How can we use the VWAP indicator?

VWAP is usually used as a S/R line. The daily VWAP and weekly VWAP are usually STRONG S/R zones. We are usually looking for a VWAP Cross, which basically means when price crosses over the VWAP and finds support, it is usually a good sign that price will start moving up, vice versa for selling; if price hits resistance on the VWAP and rejects, it is usually a good sign that price will start going down.

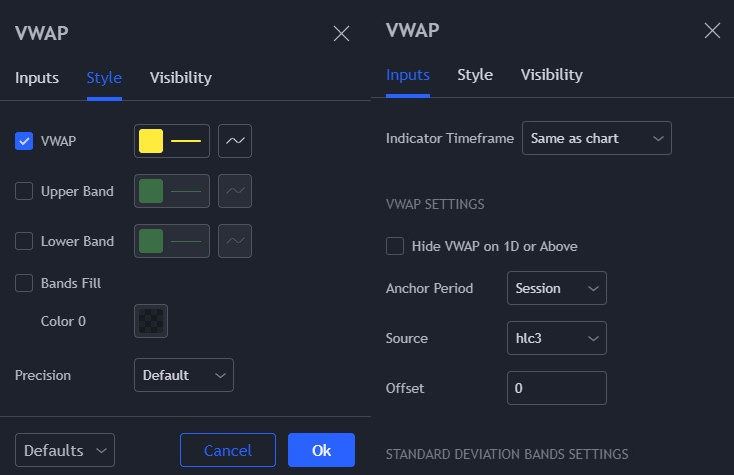

To use the VWAP in short-term trading, make sure you have the settings on session VWAP as seen below;

Color settings are totally optional, yellow just suits well for me. You need to change the Anchor Period to session for short-term trades

Using this indicator in confluence with the Stochastic RSI, Volume & Candlestick patterns, you will find success in short trades here and there;