Gold prices were little changed on Wednesday amid political turmoil in South Korea, while traders waited for more cues from key US economic data.

At the time of writing, the February gold contract on COMEX was at $2,665.39, down 0.1% from the previous close.

The job openings and labor turnover survey published by the US Bureau of Labor Statistics showed the number of job openings increased in October.

The report showed job openings in the US increased to 7.74 million in October from 7.37 million earlier.

Focus on Fed policy

The strong data comes ahead of the US Federal Reserve’s policy meeting on December 17-18.

A strong labor market and elevated inflation could prompt a less dovish stance from the Fed, which would be bearish for non-yielding metals such as gold.

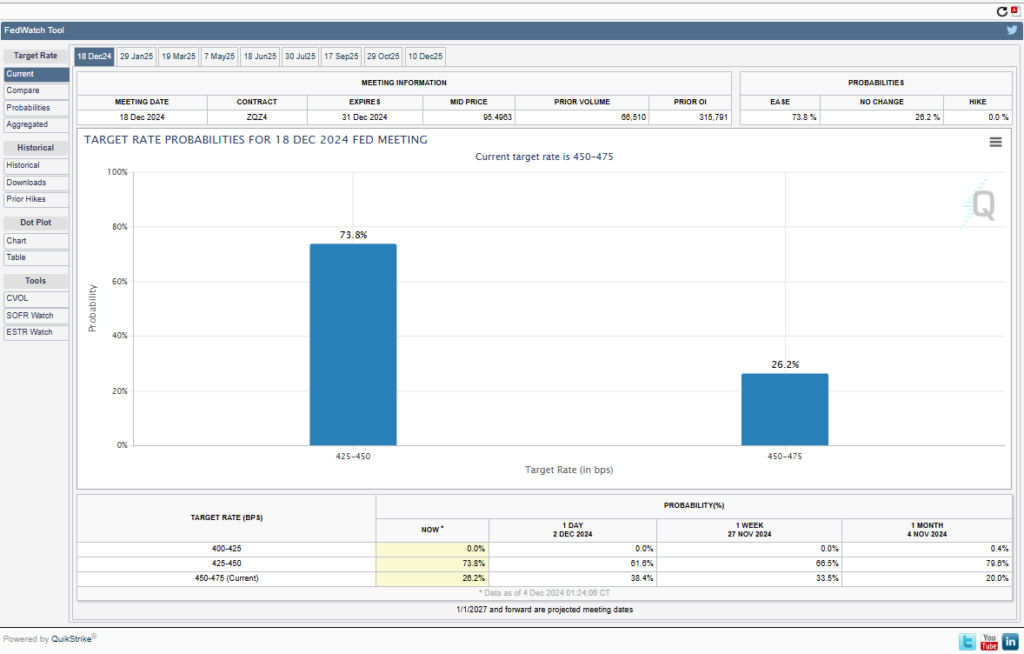

Traders are still pricing in a 73.8% probability of the US central bank cutting interest rates by 25 basis points later this month, according to the CME FedWatch tool.

Haresh Menghani, editor at FXstreet, said in a report:

The strong US labor market report comes on top of stalling progress in lowering inflation to the 2% target and suggests that the US central bank could pause its rate-cutting cycle next year.

Traders are waiting for more labor market data as the US non-farm payroll data and unemployment benefits will be released later this week.

Fed Governor Adrianna Kugler noted that the progress on inflation is still underway and the central bank will make decisions meeting by meeting and that the policy is not on a preset course.

Additionally, the focus will be on Fed Chair Jerome Powell’s speech on Wednesday.

South Korea in focus

The ongoing political turmoil in South Korea is keeping gold traders on their toes. The political uncertainty could increase the safe-haven value for the yellow metal.

South Korea’s President Yoon Suk-Yeol declared martial law on Tuesday, before swiftly rescinding the move, following opposition by the Parliament and citizens.

The Parliament entirely voted against martial law, while South Korea’s opposition party also called for Yoon’s impeachment, putting the country into its worst political crisis since the 1980s, according to a Reuters report.

The declaration of martial law by the President was to counter an opposition that was “trying to overthrow the free democracy” regime.

As the country remains one of the top economies in East Asia, the political turmoil could undermine investor sentiment, spurring safe-haven demand for gold.

Meanwhile, Israel threatened to attack Lebanon as it blamed the latter’s government for a collapse in the ceasefire with Hezbollah.

Gold price forecast

According to experts, gold prices have to consolidate above the $2,650 per ounce mark for further upside.

“So far, it has been unable to break and hold above $2,650. This suggests that gold could be stuck in a range until there’s an obvious shift in momentum,” Trade Nation’s Morrison said.

On the upside, the $2,666 per ounce is an immediate resistance to prices.

“The next relevant hurdle is pegged near the $2,677-2,678 zone, above which the Gold price could aim to reclaim the $2,700 round figure,” Menghani said.

If gold prices breach the above levels, the metal could face some stiff resistance around $2,721-$2,722.

He added:

A sustained strength beyond the latter might shift the bias in favor of bullish traders and pave the way for some meaningful appreciating move in the near term.

Metals market down ahead of Powell’s speech

Among other metals, silver, copper and platinum were all in the red on Wednesday as the market waited for Powell’s speech.

Powell’s speech would be closely monitored as it could give away further cues on the Fed’s stance on interest rates.

The prospect of a less dovish outcome from the policy meeting of the Fed later this month weighed on the metals complex.

Elevated rates in the US mean fewer investments and higher borrowing costs for industries, which limits demand for metals such as copper and silver.

At the time of writing, the March silver contract on COMEX was $31.348 per ounce, down 0.5%. The three-month copper contract on the London Metal Exchange was down 0.1% at $9,118.50 per ton.

The post Gold prices steady amid South Korea’s political turmoil, US economic data in focus appeared first on Invezz

Source link